Delve into the world of car insurance premiums with our guide on shopping for quotes to secure the best annual rates. Uncover the secrets to saving money and finding the ideal coverage for your vehicle.

Explore the factors that influence premiums, tips for finding the lowest rates, and how to compare quotes effectively online. Get ready to make informed decisions about your car insurance needs.

Importance of Shopping for Car Insurance Quotes

When it comes to purchasing car insurance, shopping around for quotes is crucial to ensure you get the best deal possible. By comparing multiple quotes from different insurance providers, you can save money and find a policy that meets your specific needs.

Factors Influencing Annual Premiums

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums.

- Vehicle Type: The make and model of your car can affect your insurance rates, with expensive or high-performance vehicles typically costing more to insure.

- Location: Where you live can impact your premiums, as areas with higher rates of accidents or theft may result in higher insurance costs.

- Coverage Options: The type and amount of coverage you choose will directly impact your annual premiums, with more comprehensive policies generally costing more.

- Credit Score: Some insurance companies take your credit score into account when determining your rates, so maintaining good credit can help lower your premiums.

Factors Affecting Car Insurance Premiums

When it comes to calculating car insurance premiums, insurance companies take into account several key factors that can influence the cost of your coverage. These factors can vary from personal details to the type of car you drive and the coverage options you choose.

Personal Factors Impacting Insurance Rates

- Your Age: Younger drivers tend to pay higher premiums due to their lack of driving experience and higher risk of accidents.

- Driving Record: A history of accidents or traffic violations can lead to increased premiums as it suggests a higher risk of future claims.

- Location: Where you live can impact your insurance rates, with urban areas typically having higher rates due to increased traffic and crime rates.

Car-Related Factors Affecting Premiums

- Type of Car: The make, model, and age of your vehicle can influence your premiums, with luxury cars and sports cars usually costing more to insure.

- Coverage Limits: Higher coverage limits mean more protection but also higher premiums, so choosing the right balance is crucial.

- Deductible Choices: Opting for a higher deductible can lower your premiums, but you'll have to pay more out of pocket in case of a claim.

Tips for Finding the Lowest Annual Premiums

When it comes to finding the lowest annual premiums for car insurance, there are several strategies that can help you save money and get the coverage you need. Reviewing coverage options, taking advantage of discounts, and considering bundling policies are all important factors to consider.

Review Coverage Options and Discounts

Before settling on a car insurance policy, it's crucial to review the coverage options available to ensure you're getting the best value for your money. Make sure you're not paying for coverage you don't need, but also consider whether you have enough coverage in case of an accident.

Additionally, look into the discounts offered by insurance companies, such as safe driver discounts, multi-policy discounts, or discounts for having anti-theft devices installed in your vehicle.

Bundling Policies and Defensive Driving Courses

One effective way to lower your car insurance premiums is by bundling multiple insurance policies with the same provider

Another way to potentially lower your car insurance premiums is by taking a defensive driving course. These courses can not only improve your driving skills but also demonstrate to insurance companies that you are a responsible and safe driver, which could lead to lower premiums.

Comparing Car Insurance Quotes Online

When it comes to finding the best car insurance policy that suits your needs and budget, comparing car insurance quotes online can be a game-changer. Here's how you can effectively compare car insurance quotes and make an informed decision:

Benefits of Using Comparison Websites or Tools

- Save Time and Effort: Comparison websites or tools allow you to get multiple quotes from different insurance providers in a matter of minutes, saving you the hassle of contacting each provider individually.

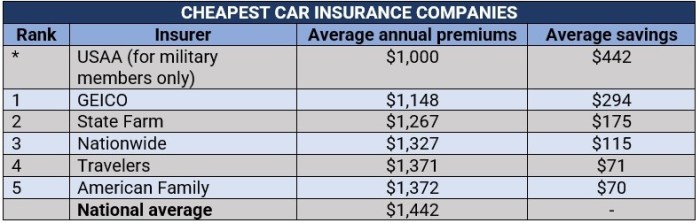

- Cost-Effective: By comparing quotes online, you can easily identify the most competitive premiums and potentially save money on your car insurance.

- Easy Comparison: These websites provide a side-by-side comparison of coverage details, premiums, and deductibles, making it easier for you to choose the best option.

Tips on Reviewing Coverage Details, Exclusions, and Fine Print

- Pay Attention to Coverage Limits: Make sure the coverage limits offered by each insurance provider meet your needs and financial protection requirements.

- Check for Exclusions: Review the policy exclusions to understand what is not covered by the insurance, such as specific damages or incidents.

- Understand the Fine Print: Take the time to read through the policy details, including terms and conditions, to avoid any surprises or misunderstandings in the future.

- Compare Deductibles: Consider the amount of deductible you are willing to pay in case of a claim and compare how it affects the overall premium.

Last Recap

In conclusion, mastering the art of shopping for car insurance quotes can lead to significant savings while ensuring optimal coverage. Take control of your insurance premiums and drive with confidence knowing you've secured the best deal possible.

Questions Often Asked

How important is it to shop around for car insurance quotes?

Shopping around allows you to compare offers and secure the lowest annual premiums tailored to your needs.

What factors influence car insurance premiums?

Factors such as age, driving record, coverage limits, and the type of car can impact insurance rates.

Are there specific strategies to find the lowest annual premiums?

Reviewing coverage options, seeking discounts, and bundling policies are effective ways to lower premiums.