Progressive Commercial Auto Insurance: Cost vs Value sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the intricacies of Progressive Commercial Auto Insurance, we uncover a world where costs meet value in a dynamic interplay that shapes the decisions of businesses.

Overview of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance offers a range of coverage options tailored to meet the specific needs of businesses with vehicles. Whether you have a single company car or a fleet of vehicles, Progressive provides comprehensive protection to keep your business moving forward.

Coverage Options Available

- Liability Coverage: Protects your business from financial loss if you're held responsible for an accident that causes injury or property damage to others.

- Collision Coverage: Covers the cost of repairs or replacement of your vehicle if it's damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Provides coverage for non-collision related incidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Helps cover medical expenses and damages if you're in an accident caused by a driver who doesn't have insurance or enough insurance.

Process of Obtaining a Progressive Commercial Auto Insurance Policy

Getting a Progressive Commercial Auto Insurance policy is a straightforward process. You can start by obtaining a quote online or by contacting a Progressive agent to discuss your specific needs. Once you've selected the coverage options that work best for your business, you can finalize the policy and start enjoying the peace of mind that comes with knowing your vehicles are protected.

Cost of Progressive Commercial Auto Insurance

When it comes to the cost of Progressive Commercial Auto Insurance, several factors come into play that influence the premiums businesses have to pay. Understanding these factors can help businesses make informed decisions when selecting their insurance coverage.

Factors Influencing Cost

- The type of vehicles being insured: The make, model, and age of the vehicles being insured can impact the cost of the policy.

- Driving history: The driving records of the employees operating the vehicles can affect the premiums.

- Location: The area where the vehicles will be primarily used can impact the cost of insurance due to varying levels of risk.

- Coverage limits and deductibles: The amount of coverage and deductibles chosen by the business will also play a role in determining the cost.

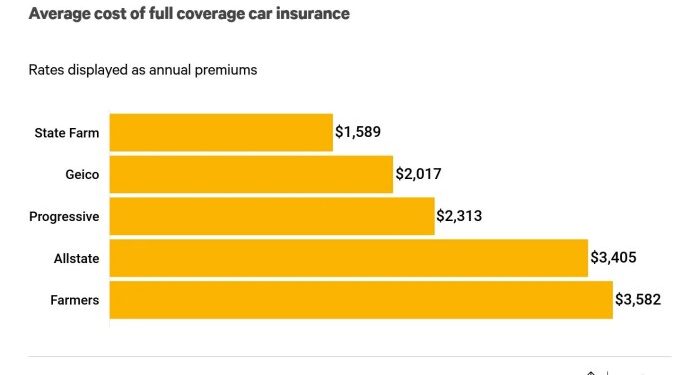

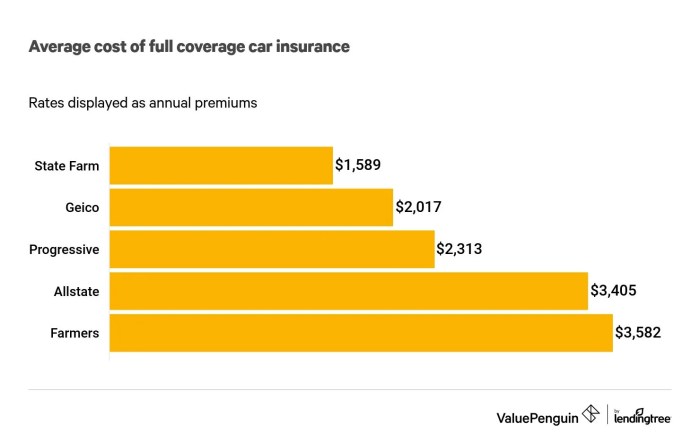

Comparison with Other Providers

- Progressive Commercial Auto Insurance offers competitive rates compared to other commercial auto insurance providers in the market.

- Businesses can benefit from comparing quotes from multiple providers to ensure they are getting the best value for their insurance needs.

Saving on Premiums

- Bundling policies: Businesses can save on their Progressive Commercial Auto Insurance premiums by bundling it with other insurance policies they may need.

- Driver training programs: Encouraging employees to participate in safe driving courses can help lower insurance costs.

- Implementing safety measures: Installing safety devices in vehicles and implementing risk management practices can also lead to savings on premiums.

Value of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance offers a valuable proposition to businesses by providing comprehensive coverage and reliable customer service. Here are some key aspects of the value it brings:

Benefits of Progressive Commercial Auto Insurance

- Customized Coverage: Progressive offers tailored insurance plans to meet the specific needs of different businesses, ensuring adequate protection for vehicles and drivers.

- Cost Savings: By providing competitive rates and discounts, Progressive helps businesses save money on their auto insurance premiums without compromising on coverage.

- Rapid Claims Processing: Progressive's efficient claims process ensures quick resolution in the event of accidents or damages, minimizing downtime for businesses.

Examples of Business Benefits

- A construction company was able to get back on track quickly after a major accident thanks to Progressive's prompt claims handling and coverage for vehicle repairs.

- A delivery service saw a significant reduction in insurance costs by switching to Progressive and taking advantage of their discounts for safe driving records.

Customer Service and Claims Process

Progressive Commercial Auto Insurance is known for its exceptional customer service, with knowledgeable agents ready to assist businesses with any insurance-related inquiries or issues. The claims process is streamlined and user-friendly, making it easier for businesses to file and track claims efficiently.

Ultimate Conclusion

In conclusion, the juxtaposition of cost and value in Progressive Commercial Auto Insurance reveals a nuanced landscape where businesses can navigate to find optimal coverage tailored to their needs. The balance between affordability and quality becomes a defining factor in the realm of commercial auto insurance, urging businesses to weigh their options carefully for a secure and prosperous future.

Answers to Common Questions

What factors influence the cost of Progressive Commercial Auto Insurance?

The cost of Progressive Commercial Auto Insurance can be influenced by factors such as the type of coverage selected, the number of vehicles insured, driving history of employees, and the location of the business.

How does Progressive Commercial Auto Insurance differentiate itself in terms of customer service?

Progressive Commercial Auto Insurance stands out for its responsive customer service, offering dedicated support to businesses in handling claims efficiently and providing assistance throughout the policy duration.

Can businesses customize their coverage options with Progressive Commercial Auto Insurance?

Yes, businesses have the flexibility to tailor their coverage options with Progressive Commercial Auto Insurance, ensuring that they receive the specific protection they need for their operations.