Exploring the impact of age and location on your auto insurance quote reveals interesting insights into how these factors shape the premiums you pay. From statistical data to real-life examples, understanding these influences can help you make informed decisions when it comes to your insurance coverage.

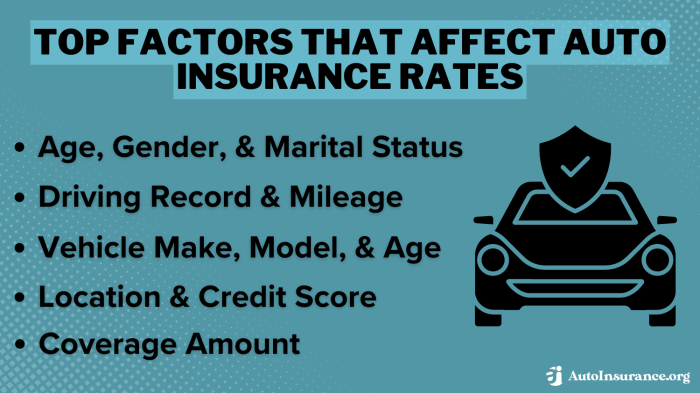

Factors Impacting Auto Insurance Quotes

When it comes to determining auto insurance quotes, age and location play a crucial role in influencing the premiums you pay. Insurance companies take into account various factors to assess the level of risk associated with insuring a particular individual or vehicle, and age and location are key components in this evaluation process.

Age Groups and Insurance Premiums

Insurance companies typically categorize drivers into different age groups, such as teenagers, young adults, middle-aged individuals, and seniors. These age groups have varying levels of driving experience and risk profiles, which directly impact the insurance premiums offered. For example, teenage drivers are often charged higher premiums due to their lack of experience and higher likelihood of being involved in accidents.

Location and Insurance Costs

The location where you reside also plays a significant role in determining your auto insurance costs. Urban areas with higher population densities and increased traffic congestion tend to have higher insurance premiums compared to rural areas. This is because the risk of accidents, theft, and vandalism is generally higher in urban settings, leading to elevated insurance costs for residents.

Significance in Insurance Calculations

Age and location are crucial factors in insurance calculations as they help insurers assess the likelihood of a policyholder filing a claim. Younger drivers and individuals living in densely populated areas are considered higher risk, leading to higher premiums to offset potential losses for insurance companies.

By considering these factors, insurers can tailor insurance quotes to reflect the specific risk profile of each policyholder accurately.

Impact of Age on Auto Insurance

Age is a significant factor that plays a crucial role in determining auto insurance rates. Insurance companies use age as an indicator of risk, with younger and older drivers typically facing higher premiums compared to middle-aged drivers. This is due to statistical data that shows how age affects the likelihood of accidents and claims.

Youthful Drivers vs. Older Drivers

- Young drivers, typically under the age of 25, are considered high-risk due to their lack of driving experience and tendency for risky behavior on the road. As a result, they often face higher insurance premiums.

- Older drivers, usually above the age of 65, may also experience higher insurance rates due to factors such as declining eyesight, slower reaction times, and potential health issues that could affect their driving abilities.

- Drivers between the ages of 30 and 65 are generally considered to be in a lower-risk category, leading to lower insurance premiums compared to younger and older age groups.

Statistical data shows that drivers under the age of 25 are more likely to be involved in accidents and make insurance claims compared to older age groups.

Influence of Location on Auto Insurance

Location plays a crucial role in determining auto insurance premiums. Insurance companies take into account various factors related to your geographical area when calculating your rates. Let's delve into how location impacts your auto insurance costs.

High-Risk Areas and Impact on Insurance Costs

Living in a high-risk area can significantly impact your auto insurance premiums. Areas with high crime rates or high traffic congestion are considered riskier for insurers. This increased risk of accidents or theft can lead to higher insurance costs for residents in these areas.

- High Crime Rates: Areas with a high incidence of car theft or vandalism are considered high-risk by insurance companies. If you live in a neighborhood with a high crime rate, you may face higher insurance premiums to account for the increased likelihood of theft or damage to your vehicle.

- Traffic Congestion: Locations with heavy traffic congestion are more prone to accidents. Insurers may charge higher premiums to drivers in these areas due to the elevated risk of collisions. The likelihood of accidents increases in congested areas, leading to higher insurance costs for residents.

Importance of Factors in Determining Premiums

Insurance companies consider various factors related to your location when determining your auto insurance premiums. Factors such as crime rates, traffic patterns, and the frequency of accidents in your area all play a role in the calculation of your insurance costs.

Insurance companies use statistical data to assess the risk associated with different locations, influencing the premiums charged to policyholders.

- Crime Rates: Areas with high crime rates may experience more incidents of vehicle theft or vandalism, leading to increased insurance costs for residents.

- Traffic Patterns: Locations with heavy traffic congestion are more prone to accidents, resulting in higher insurance premiums for drivers in these areas.

- Accident Frequency: Areas with a high frequency of accidents may see higher insurance rates, as insurers factor in the likelihood of claims being filed by policyholders in these regions.

Demographic Trends in Auto Insurance

Demographic trends play a significant role in the auto insurance industry, affecting how insurance companies determine pricing for their policies. By analyzing demographic data related to age and location, insurance companies can adjust their rates accordingly. Let's delve into how these trends impact auto insurance pricing and the ethical considerations involved.

Impact of Age and Location on Auto Insurance Pricing

- Younger drivers tend to pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

- Older drivers, on the other hand, may receive discounts as they are considered more experienced and less risky to insure.

- Urban areas with higher population densities and increased traffic congestion often face higher insurance rates compared to rural areas with lower traffic volumes.

- Specific neighborhoods within cities may have higher rates of theft or vandalism, leading to increased insurance costs for residents in those areas.

Final Summary

As we conclude our discussion on how age and location impact your auto insurance quote, it becomes evident that these variables are crucial in determining the costs of your coverage. By recognizing the significance of age and location in insurance calculations, you can navigate the complexities of the insurance market more effectively.

Expert Answers

How does age affect auto insurance quotes?

Age influences auto insurance quotes by affecting the likelihood of accidents and claims. Generally, younger drivers tend to pay higher premiums compared to older, more experienced drivers.

What role does location play in determining auto insurance costs?

Location impacts auto insurance pricing through factors like crime rates and traffic congestion. High-risk areas often result in higher insurance costs due to increased chances of accidents or theft.

Do insurance companies adjust pricing based on demographic trends?

Yes, insurance companies utilize demographic data, including age and location, to adjust pricing. This data helps insurers assess risk levels and set premiums accordingly.