Delve into the world of Commercial Auto Policy Renewal Guide for Fleet Owners, where essential information awaits fleet owners seeking clarity on the renewal process. This guide is designed to provide valuable insights and practical advice for a seamless policy renewal experience.

In the following paragraphs, we will explore key aspects of policy coverage, factors affecting premiums, renewal processes, and the importance of reviewing policy limits.

Overview of Commercial Auto Policy Renewal Guide

Commercial auto policy renewal guides serve as essential tools for fleet owners to navigate the process of renewing their insurance policies. These guides provide detailed information and instructions to ensure a smooth and efficient renewal process.

Purpose of Policy Renewal Guide

A policy renewal guide is designed to help fleet owners understand the steps they need to take to renew their commercial auto insurance policy. It Artikels key deadlines, requirements, and options available to them during the renewal process.

Importance of Understanding the Renewal Process

- Ensures Compliance: Fleet owners need to understand the renewal process to ensure that they remain compliant with insurance regulations and maintain coverage for their vehicles.

- Cost-Effective Decisions: Understanding the renewal process allows fleet owners to make informed decisions about coverage options, deductibles, and premiums, helping them save costs.

- Smooth Transition: By knowing how the renewal process works, fleet owners can smoothly transition from their expiring policy to the renewed one without any gaps in coverage.

Key Components of a Commercial Auto Policy Renewal Guide

- Renewal Timeline: Details the deadlines and timeline for submitting renewal documents and payments.

- Coverage Options: Explains the different coverage options available for commercial auto insurance policies, helping fleet owners choose the most suitable coverage for their needs.

- Premium Breakdown: Provides a breakdown of the premium cost, including factors that may impact the premium amount.

- Policy Updates: Highlights any changes or updates to the policy terms and conditions that fleet owners need to be aware of.

- Contact Information: Lists contact details for the insurance provider's customer service or agent for any questions or assistance during the renewal process.

Understanding Policy Coverage

When renewing a commercial auto policy for fleet owners, it is crucial to understand the different types of coverage available to ensure adequate protection for your vehicles and drivers.

Types of Coverage

- Comprehensive Coverage: This type of coverage helps protect fleet vehicles from non-collision related incidents such as theft, vandalism, fire, or natural disasters.

- Liability Coverage: Liability coverage helps cover costs associated with bodily injury or property damage to others in the event of an accident where the fleet owner is at fault.

Comparison of Comprehensive vs. Liability Coverage

Comprehensive coverage provides protection for fleet vehicles in situations beyond accidents, offering a more extensive range of coverage compared to liability coverage. On the other hand, liability coverage is essential for covering costs related to accidents where the fleet owner is deemed responsible.

Examples of Beneficial Situations

- Comprehensive Coverage: If a fleet vehicle is vandalized overnight or damaged in a storm, comprehensive coverage would help cover the repair or replacement costs.

- Liability Coverage: In the event of an accident where a fleet vehicle causes damage to another vehicle or property, liability coverage would assist in covering the repair or replacement expenses.

Factors Affecting Premiums

When it comes to commercial auto insurance, there are several factors that can impact the premiums a fleet owner pays. These factors can range from the size and composition of the fleet to the safety record and driving history of the fleet owner.

Understanding these factors is crucial for fleet owners to make informed decisions about their insurance coverage.

Fleet Size and Composition

The size and composition of a fleet play a significant role in determining insurance premiums. Larger fleets with more vehicles are generally associated with higher risks, which can result in higher premiums. Additionally, the type of vehicles in the fleet, such as trucks or passenger vehicles, can also impact premium rates.

Fleet owners should carefully consider the size and composition of their fleet when assessing their insurance needs.

Safety Record and Driving History

A fleet owner's safety record and driving history are key factors that insurance companies consider when determining premiums. A history of accidents or traffic violations can lead to higher premiums, as it indicates a higher level of risk. On the other hand, a clean safety record and driving history can result in lower premiums, as it demonstrates a commitment to safe driving practices.

Fleet owners should prioritize safety and compliance to maintain affordable insurance coverage

Renewal Process and Timeline

When it comes to renewing a commercial auto policy, fleet owners need to be aware of the typical timeline and steps involved in the process. By understanding the renewal process and preparing in advance, fleet owners can ensure a smooth policy renewal experience.

Typical Timeline for Renewal

Renewing a commercial auto policy usually begins around 30 to 45 days before the current policy expiration date. It is important for fleet owners to start the renewal process early to allow ample time for any necessary adjustments or negotiations.

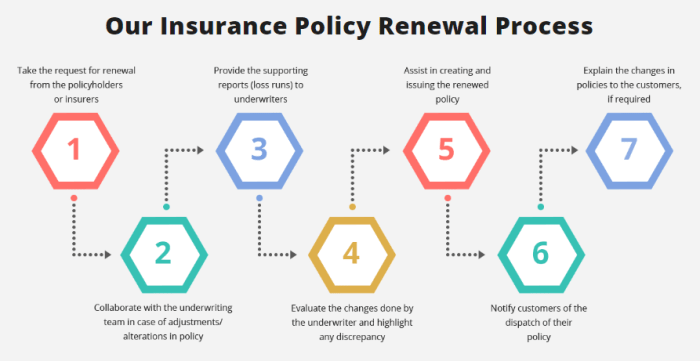

Steps in the Renewal Process

- Reviewing Current Policy: Fleet owners should carefully review their current policy to understand the coverage, limits, and any changes that may be needed.

- Assessing Fleet Needs: Evaluate the fleet's requirements and any changes that have occurred since the last policy renewal.

- Comparing Quotes: Obtain quotes from multiple insurers to ensure competitive pricing and comprehensive coverage options.

- Negotiating Terms: Work with insurance providers to negotiate terms, premiums, and any specific requirements based on the fleet's needs.

- Finalizing Renewal: Once all terms are agreed upon, finalize the renewal process by signing the necessary documents and making the premium payment.

Tips for Smooth Policy Renewal

- Start Early: Begin the renewal process well in advance to avoid any last-minute rush or disruptions in coverage.

- Organize Documents: Keep all relevant documents, such as vehicle information, driver details, and claims history, handy for a seamless renewal process.

- Communicate Clearly: Maintain open communication with insurance providers to address any queries or concerns promptly.

- Consider Bundling Policies: Explore the option of bundling multiple insurance policies for potential cost savings and streamlined management.

- Seek Professional Advice: If needed, consult with insurance experts or brokers to navigate complex policy terms and ensure the best coverage for your fleet.

Reviewing and Updating Policy Limits

When it comes to renewing your commercial auto policy as a fleet owner, reviewing and updating your policy limits is crucial to ensure adequate coverage for your operations. Changes in fleet size or the nature of your business can impact the level of coverage needed, making it essential to adjust policy limits accordingly.

Importance of Reviewing Policy Limits

- Regularly reviewing policy limits helps ensure that your coverage aligns with the current needs and risks of your fleet.

- Failure to update policy limits can result in being underinsured in case of an accident or claim, leading to financial losses for your business.

- By reviewing and updating policy limits, you can better protect your assets, employees, and the reputation of your business.

Changes in Fleet Size or Operations

- Expanding your fleet or adding new types of vehicles may require an increase in policy limits to adequately cover the added risks.

- Conversely, downsizing your fleet or changing the focus of your operations could mean that you no longer need the same level of coverage, allowing for potential cost savings.

Scenarios for Updating Policy Limits

- If your fleet has grown significantly since the last policy renewal, it may be necessary to increase your liability limits to account for the increased exposure to risk.

- Introducing new delivery routes or expanding into new territories could also warrant a review of policy limits to ensure coverage in all operating areas.

- In the event of regulatory changes impacting insurance requirements for commercial vehicles, updating policy limits can help you stay compliant with current laws and regulations.

Closure

In conclusion, understanding the nuances of commercial auto policy renewal is crucial for fleet owners to make informed decisions and ensure adequate coverage for their vehicles. By following the guidelines Artikeld in this guide, fleet owners can navigate the renewal process with confidence and peace of mind.

Detailed FAQs

What are the key components included in a commercial auto policy renewal guide?

The key components typically included are policy coverage details, premium factors, renewal timeline, and tips for preparation.

How does fleet size and composition influence premium rates?

Large fleets or those with high-risk vehicles may attract higher premium rates due to increased exposure to potential claims.

When should fleet owners consider updating policy limits?

Fleet owners should consider updating policy limits when there are changes in fleet size, operations, or if they want to ensure adequate coverage for new risks.